Cashbean Kya hai ?

Cashbean ek RBI registered NBFC company hai ko short term ke liye logo ko short term ke liye loan provide karati hai, vo bhi instant cash loan in 1 hour in india

Cashbean se aap loan instantly pe le dakte hai ye bahut fast kaam karta hai saare process automated system par hota hai aur aapka applied loan 2hrs pe Cashbean se disbursement ho jata hai

Cashbean how it works

| image source: CASHBEAN FACEBOOK PAGE |

- Cashbean is real or fake

- Cashbean Loan Tenure

Cashbean Kaun se Loan deta Hai

- Personal Loan

- Salary advance

- cash loan

- Online Loan

- Instant loan (Recommended) – ye loan ₹ 1,500 to ₹ 50,000 tak deta hai Bina kisi credit history ke

- Quick Loan

- Private Loan

- Small Loan Fast Loan

Cashbean how much interest

How Cashbean Work?

- STEP-1

Note: agar aap cashbean se loan lene ka soch rahe hai to aap hamare refereal code :bp8pm use kar Rs.50- Rs.200 Tak ka discount pa sakte hai

- STEP-2

- STEP-3

- STEP-4

- STEP-5

Cashbean Customer Care number

Agar aap Cashbean loan app se loan lete hai aur aapko payment pe koi dikkat ho rahi ho to aap cash bean ke support team ke saath diye gaye toll Free number pe call kar help le sakte hai

Cashbean toll free number 18005728088

Cashbean Loan Repayment Online

Cashbean is safe or not

Cashbean se Loan Lene se CIBIL Score Badhta hai

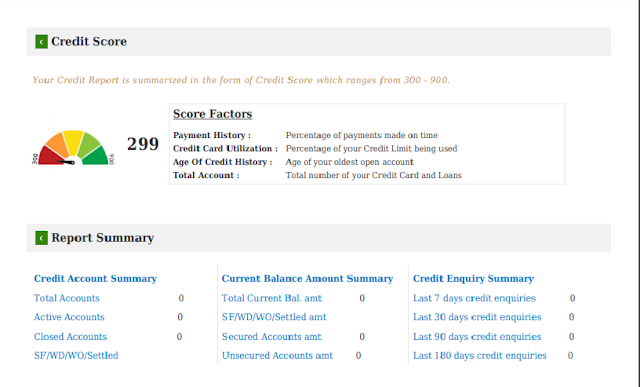

Ji Haan agar aap Cashbean se Loan lete hai aur sahi time pe Repayment karte hai to aapka cibil score zaoor badhega. Maine jab first time Cashbean se loan liya tha tab mera CIBIL Score -0 tha but loan lene ke baad jab maine time pe replayment kar diya to mera CIBIL Score 299 ho gaya. jise aap niche diye gaye screenshot ke zariye dekh sakte hai.

Cashbean Interest Policy

| Type of Charge | Charge % / INR |

|---|---|

| Processing fee |

Upto Rs.3000 as per loan amount

Loan foreclosure/pre-payment charges

Rs. 0 per request

Rate of Interest

Not exceed 33% p.a

Bounce charges

Rs. 0 per request

Late Payment penalty

2% per day

Stamp duty charges for loan documentation

As per applicable laws

Boost Protect Fee

Upto 3% per request but will be waived-off as our offer policy

Duplicate NOC

Rs. 0 per request

Repayment mandate/instrument swapping charges

Rs. 0 per request

Loan Cancellation Charges

Rs. 0 per request

Loan Re booking charges

Rs. 0 per request

Statement of account charges

Rs. 0 per request

Duplicate Repayment Schedule

Rs. 0 per request

Bounce Charges (For Self Employed)

Rs. 0 per request

Membership Fee

For Primary Membership:

1 month: Rs.120

3 month: Rs.250

For senior Membership:

3 month: Rs.300

6 month: Rs.600

Final Word

Agar aap yeha se loan lete hai aur aap time pe installment nahi dete hai to inke customer care ke log aapko phone kar kar ke pareshan kar sakte hai yehi nahi agar aapne apna phone switch off kar diya to aapke diye gaye numbers pe ye phone kar pareshan karenge.

Mere Personal review se kahunga agar aap bahut he musibat mein pade hai aur aapke pass koi dusra option nahi hai tabhi aap yeha se Loan le warna main aapko iss app se loan lene ke liye kabhi recommended nahi karunga.